Fed up with overspending and want to cut expenses without losing your favorite things? No more worries! Saving is easier when you plan things correctly. From shopping to food, there are different ways you can cut your costs effectively. We help you figure out the best ways to save money through simple and realistic strategies.

How to Save Money Easily?

Getting started is the most challenging part of saving money. You can save money in your daily life by following these ten methods.

1. Reduce Shopping Expenses

Shopping during sales and discount seasons help you save more. You can create a shopping list before you go to the store. Learn about loyalty programs and coupons to increase your savings. You can avoid the things you don’t need to cut off extra costs. Follow these tips to control impulsive online shopping.

2. Minimize Restaurant Spending

The price in a restaurant is quite higher compared to cooking at home. Try to avoid restaurant meals continuously. If you like to eat meals at restaurants, make use of a credit card that offers restaurant discounts but you must clear the payment in the same pay cycle instead of opting for EMIs. You can also skip desserts and drinks that lower your budget as well.

3. Get Discounts on Entertainment

You can visit national parks and museums on free days to save on entertainment costs. Some local communities offer free virtual events and concerts. So, you can book those events instead of paying high prices for private concerts.

4. Lower Electricity Bill

A small change in your energy usage can save you hundreds of dollars on electricity bills per year. Consider using smart power strips, thermostats and plugging insulation leaks in your home. A slight drop in monthly electricity usage has a great impact on your savings.

5. Cancel Unnecessary Subscriptions

Stop paying for the subscriptions you no longer need or use. Reviewing your bank statement helps eliminate repeated expenses. Avoid signing up for free trials, and set a reminder calendar to end the free period.

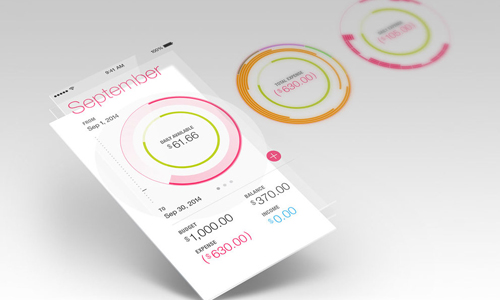

6. Track Spending

Are you spending money on the right things? If not, make a note of your monthly cash flow, including your income and other expenditures. This will help you focus more on your savings goal. Track your spending daily for better savings in the future.

7. Set Saving Goals

Setting a goal is the best way to save money. You can set both short and long-term goals for better savings. Then, evaluate your money and plan things accordingly. You can calculate your child’s education and home project based on long-term goals. On the other hand, your vacation expenses and emergency expenses fall under your short-term goals.

8. Buy Jewelry From Trusted Store

If you are looking for high-quality jewelry, shopping at trusted stores can save you money. They sell different types of jewelry directly to customers by eliminating other retail intermediaries. You must be aware of taxes and know the store’s return policy to get a good idea about the jewelry.

9. Open a High-Yield Savings Account

You can open a savings account to transfer your money on a monthly basis. You can automate your savings by sending a specific amount of payment to this account. Also, you can try other investment options such as mutual funds, gold, direct equity, and other post-office schemes.

10. Buy Furniture From Manufacturers

Another way to save money is to buy furniture directly from manufacturers. They will make the perfect customized furniture outlets you love. You can plan a realistic budget to build your own furniture.

Hope you understand the best ways to save money in your day-to-day life. Automating your savings, setting goals, cutting down on spending, and paying off debts ensures you save money well. All these savings goals start when you commit yourself. Start reducing expenses and building wealth over time.

Hayley

Related posts

Women Tips

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |